དངུལ་རྩིས་ལྷན་ཁག། དཔལ་ལྡན་འབྲུག་གཞུང་།

Ministry of Finance

Royal Government of Bhutan

Menu

Department of Revenue & Customs

About Us

The Department of Revenue & Customs is responsible for collecting taxes and duties, facilitating trade, and enforcing customs laws. It ensures efficient revenue mobilization, promotes compliance, and supports economic growth through transparent and effective tax and customs administration.

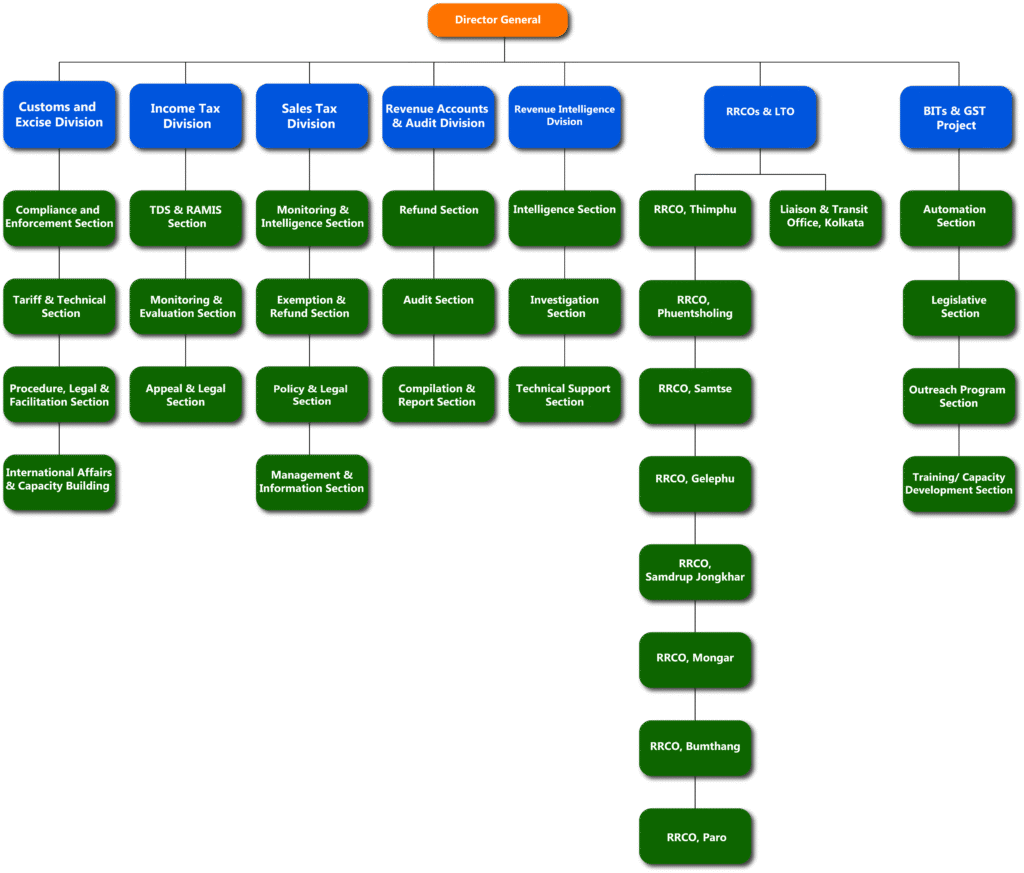

Organisation Chart

The Organisation Chart of the Department of Revenue and Customs, Ministry of Finance, illustrates the structured hierarchy, roles, and functional divisions for effective tax administration and revenue management.

Divisions

Tax Administration Division

- Implement and monitor the administration of income tax law.

- Review and appraisal of policy related issues.

- Revision of the Income Tax Act and rule as needed from time to time.

- Advice, guide, and monitor the RRCO’s in the implementation of the Act and Rule.

Customs and Excise Division

- Implement and monitor the administration of Customs and Excise Laws.

- Review and advise the Ministry of Finance on policies and matters related to the Customs and Excise Division.

- Coordinate with other law enforcement agencies in monitoring and prevention of the smuggling of restricted and prohibited goods.

- Facilitate legitimate trade by ensuring the smooth, timely, and efficient movement of goods across borders while minimizing unnecessary delays and costs for compliant traders.

- Simplify, modernize, and harmonize Customs procedures in alignment with international standards and best practices, such as those outlined in the WTO Trade Facilitation Agreement and the WCO Revised Kyoto Convention, to enhance transparency, predictability, and efficiency in cross-border trade operations.

- Liaise with the World Customs Organisation, Regional Customs Administrations and other relevant international agencies.

Revenue Audit and Accounts Division

- Implement and monitor the Property Tax Laws

- Implement and monitor the Property Ownership Transfer Tax Laws

- Assessment, collection and deposit of national revenue.

- Investigate revenue irregularities.

- Advice and interrupt the rules and procedures in revenue matters to revenue agencies.

- National revenue forecast on fiscal year basis as well as for the plan period.

- Produce the national revenue report.

- Process refund from the government revenue account.

Sales Tax Division

- Implement and monitor the Sales Tax, Customs and Excise Act of the Kingdom of Bhutan, 2000 and the Rules.

- Review and advise the Ministry of Finance on policy planning and revision of rules/procedures.

- Issue and monitor Sales Tax Exemption (STEC) on plants, machinery, spare and raw materials etc.

- Refund of Sales Tax.

Revenue Intelligence Division

- Intelligence Gathering and Analysis.

- Investigation of Direct and Indirect Tax Offences.

- Detection and Investigation of Economic Crimes

- Risk Identification and Profiling.

- Preventive Enforcement Operations.

- Support to Tax Policy and Field Operations.

- Institutional Collaboration and Information Sharing.

GST and BITS Project Office

GST

- Amend GST Act of Bhutan 2020;

- Finalise GST Rules and Regulations;

- Train DRC officials and Other Stakeholders on GST Act and Rules.

- Conduct GST Outreach Program

BITS

- Develop GST and Excise System and Income Tax System,

- Integrate BITS with other Stakeholder Systems.,

- Create ICT infrastructure to host BITS,

- Deliver Training on BITS for DRC officials and End Users.

Information Division

- Public Information Services

- Dissemination of direct and indirect tax information, rules and regulation through traditional and social media platforms.

- Production of infocommunication materials

- Management of the call center.

2. IT Section

- System maintenance

- Technology infrastructure and security

- Data management and integrity

- User support and capacity building

Taxation System

Historical Background

Before 1960:- Taxes were collected in kind and in the form of Labour contributions. Taxes in kind were gradually phased out to be replaced by nominal monetized tax on.

Main features:

- BIT on net profit replaced 2{f0d3e8f17a3052af75dc5b67cdb13693149f915d8e6e5e6ce02b4eaab0163573} turnover tax

- Export income exempted

- Plant machinery exempted from sales tax and import duty

- Rental income tax and other nuisance taxes were abolished.

- Tax on export of cardamom abolished.

Tax Reform in 1992

Purpose:

- Rationalisation of tax structure

- Expansion of tax base

- Simplification of administrative procedures for compliance and transparency

Tax Reforms in 2001

- Income Tax Act of 2001 enacted

- Personal Income Tax introduced

- Sales Tax, Customs and Excise Act of 2000 enacted

Tax Reforms in 2017

- Customs Act of Bhutan 2017 enacted

Tax Reforms in 2020

- GST Act of Bhutan 2020 enacted

- Property Ownership Transfer Tax Act 2020 enacted.

Tax Reforms in 2022

- Property Tax Act 2022 enacted

Publications

Sister Sites

Location

Copyright © 2025 - Ministry of Finance\Developed by WONS