Goods and Services Tax (GST) Act 2020 link

1,838 total views, 1 views today

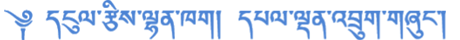

Public Notifications issued by Ministry of Finance

Goods and Services Tax (GST) Act 2020 link

1,838 total views, 1 views today

Rules on the Property Ownership Transfer Tax Act of Bhutan 2020 Read more

2,044 total views, 1 views today

1,326 total views, 2 views today

1,633 total views, 1 views today

30,449 total views, 1 views today

2,610 total views, 1 views today

1,867 total views, 1 views today

This website is brought to you by the Ministry of Finance, Royal Government of Bhutan. Any content on this site shall not be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission of the publisher, except in the case of brief quotations embodied in reviews and certain other non-commercial uses permitted by the copyright.

Your traffic is being monitored and any suspicious traffic will result in blocking the IP address.